Your cart is currently empty!

Research Reports

Global Consumer Spending on Media Forecast 2024-2028

Description

PQ Media’s 11th annual Global Consumer Spending on Media Forecast 2024-2028 delivers the most comprehensive and actionable strategic intelligence on consumer spending on digital and traditional media content and related technology, including econometric data and analysis of the 2 overall spending sectors (media content and tech); 5 total spending segments (unit purchases, content subscriptions, access, devices and software); and 28 digital and 14 traditional media content and tech categories.

The new edition of the Forecast is designed to provide media industry stakeholders like you with mission-critical market research, insights and growth projections you need to make smarter business decisions in a fast-changing global media economy.

PQ Media analysts utilize our proven econometric methodology to collect, analyze and synthesize market intelligence to project outcomes across all categories of consumer spending on digital and traditional media content, access, technology, software and services in the top 20 global markets and the rest of the countries in the 4 major regions worldwide.

With the growth challenges and opportunities posed by several key macroeconomic variables in 2023 and 2024, such as stabilizing global inflation, high interest rates and geopolitical tensions, we understand your critical need for a trusted research partner to deliver consistent, reliable and in-depth data, analysis, market sizing and segmenting, and actionable PEST trend research and growth projections to help you benchmark your performance, improve strategic planning and enhance tactical execution.

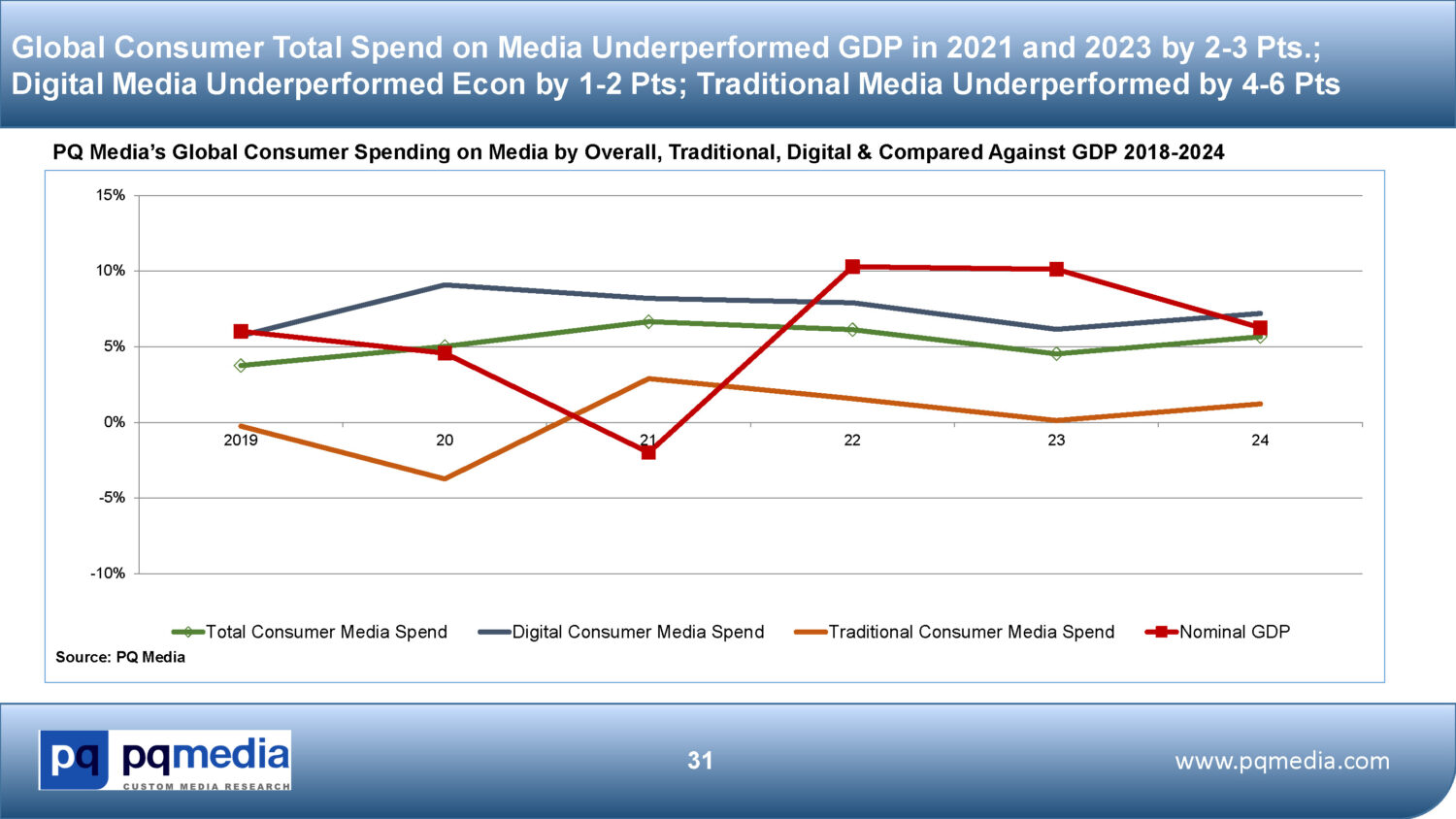

Global consumer media & tech expenditures were up 4.5% in 2023 to $2.272 trillion, the second consecutive year of decelerating growth after two consecutive years of strong growth in 2021 (6.7%) and in 2022 (6.1%). Consumer media spend posted its weakest growth rate since 2019 as the highest inflation rates in 15 years led many consumers to cut discretionary outlays. A few bright spots last year included audio streaming subscriptions and filmed entertainment, as the movie industry continued to rebound from the pandemic-fueled crater in 2020.

Nevertheless, PQ Media expects the 2024-2028 period to be robust, fueled by international sporting events that will drive up spending on television, including new TV sales, streaming video subscriptions and VOD fees for various popular sports in particular nations, such as cycling in the Netherlands and beach volleyball in Brazil, among others, as the Paris Summer Olympics will fuel consumer demand in Western European countries, where other major sporting events, like basketball and soccer, will be telecast during prime time.

The same phenomenon will propel the North and South American markets, when the United States, Canada and Mexico tri-host the FIFA World Cup in 2026, and the US hosts the Summer Olympics in 2028. Meanwhile, other media like radio, newspapers and magazines will also exhibit higher end-user spend during even years when more political elections will be held, including 15 of the top 20 global markets in 2024.

While the pandemic briefly interrupted key secular trends in 2020-2021, this was a near-term disruption of long-term trends that resumed in 2022 and will continue during the 2024-2028 period, such as decelerated growth or outright declines in various digital and traditional media and tech categories like dial-up internet; music CDs and CD players; and video DVDs and DVD players, according to the new Global Consumer Spending on Media Forecast 2024-2028.

Despite these macroeconomic headwinds, PQ Media’s new Forecast provides you with the following two key deliverables crafted to give you the actionable market intelligence you need to achieve your strategic growth objectives in the post-pandemic era:

- PDF Report & Analysis in PowerPoint format delivering over 500 slides of keen market insights, with 125 slides of analysis and 350 exclusive datagraphs for more efficient and effective strategic comparisons, internal reporting and client presentations;

- Deep-Dive Excel Databook providing 150 spreadsheet tabs, with detailed datasets by country, media sector, segment and category, which include nearly 100,000 datasets and data points to give you the most comprehensive perspective of consumer media & tech spending markets available anywhere.

The following are just some of the key features and benefits you will receive with a site license to the new edition of the Forecast:

- Deep-Dive Profiles of the Top 20 Global Media Markets in All 4 Major Regions;

- Spending & Growth Data for 2015-2025, with 5-Year Forecasts to 2025;

- 2 Overall Consumer Media Spending Sectors:

- Consumer Content

- Consumer Technology

- 5 Consumer Media Spending Segments

- Content Unit Purchases

- Content Subscriptions

- Access

- Devices

- Software & Services

- 28 Digital Media & 14 Traditional Media Spending Categories;

- 11 Hybrid (Digital & Traditional) Consumer Media Spending Silos;

- Global Consumer Media Content & Technology Market Rankings by:

- Total Spending, Growth & Share by Country

- Annual Per Capita Spending & Growth

- Digital vs. Traditional Media & Tech Spending Shares of Markets

To download a FREE Executive Summary and Sample Datasets from the new Global Consumer Spending on Media Forecast 2024-2028, please fill out the short form that appears after you click the “Free Sample Download” button above. Please ensure your email address is correct because it will be used to send you the links necessary to download the free report samples.