Your cart is currently empty!

Research Reports

Global Consumer Spending on Media Forecast 2021-2025

Description

PQ Media’s 9th annual Global Consumer Spending on Media Forecast 2021-2025 delivers the most comprehensive and actionable strategic intelligence on consumer spending on digital and traditional media content and technology, including econometric data and analysis 2 overall spending sectors (media content and technology); 5 total spending segments (unit purchases, content subscriptions, access, devices, and software); and 28 digital and 14 traditional media content and technology categories.

The new edition of the Forecast is designed to provide media industry stakeholders like you with mission-critical market research, insights and growth projections you need to make smarter business decisions in a fast-changing global media economy. PQ Media analysts utilize our proven econometric methodology to collect, analyze and synthesize market intelligence to project outcomes across all categories of consumer spending on digital and traditional media content, access, technology, software and services in the top 20 global markets and the rest of the countries across all 4 major regions.

With the growth challenges posed by several key variables in 2022, including the Omicron variant, rising global inflation, potential interest rate hikes and geopolitical tensions in Eastern Europe, we understand your critical need for a trusted research partner to deliver consistent, reliable and in-depth datasets, market segmenting and sizing, PEST trend analysis and actionable growth projections to help you benchmark your performance, improve strategic planning and enhance tactical execution.

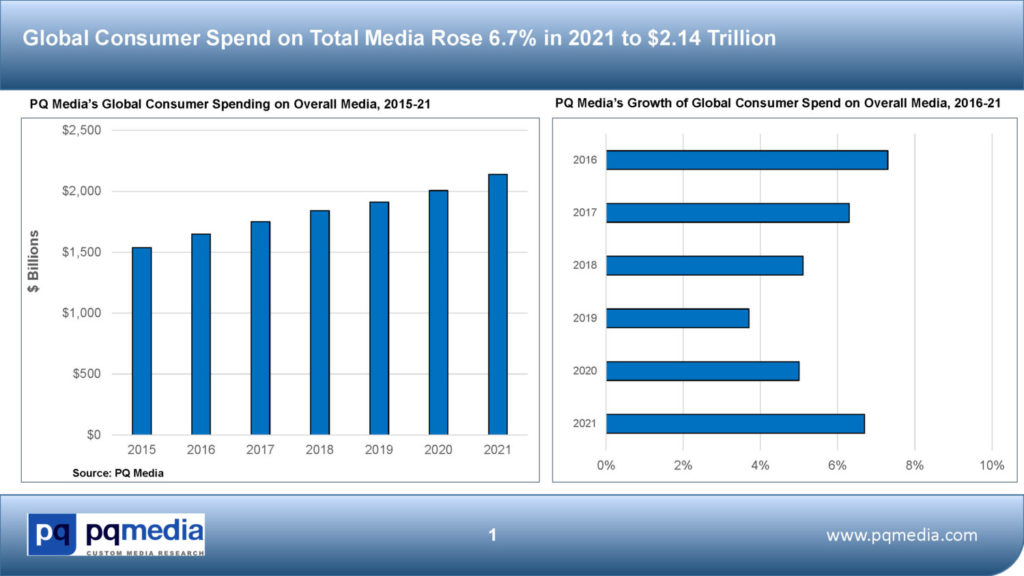

Overall global consumer spending on media content and technology grew at an accelerated 6.7% in 2021 to $2.139 trillion, the second consecutive year of faster annual growth and the strongest growth in consumer expenditures in nearly a decade. Fueling the accelerated expansion were double-digit increases in spending on digital audio, streaming video, digital news and online gaming services, as well as in-theater movie tickets, which rebounded sharply from the unprecedented decline in 2020 due to the pandemic lockdowns.

While the overall gain in consumer media & tech spend was a strong acceleration from the pandemic-fueled 4.7% surge in 2020, PQ Media expects the growth of consumer media spend will begin to decelerate in 2022 and lose even more steam during the 2023-2025 period, as many of the pandemic-driven forces that sparked the unexpected splurge in consumer spending in 2020 began to fade in the second half of 2021.

While the pandemic briefly interrupted key secular trends in 2020 and 1H 2021, this was a near-term disruption of long-term trends that will resume in the 2022-2025 period, such as decelerated growth or outright declines in various traditional and digital media content and technology categories. As such, PQ Media’s research team designed the new Global Consumer Spending on Media Forecast 2021-2025 to help you answer the difficult questions you’re facing due to the threats posed by several emerging headwinds in 2022, including:

- PQ Media’s research indicators signal that device penetration is reaching saturation in many of the world’s top media markets, and we expect more meager gains and even declines in spending on smartphones, wireless access plans, tablets, cable TV and broadband access from 2022-2025;

- While streaming video subscriptions continue to post double-digit growth in major markets, our research shows an alternative form of “cord-cutting” happening in which consumers sign up for free trials, then drop the service after binge-watching a particular series;

- Podcast subscriptions and improved foreign-language playlists are driving digital audio spend, which ranks among the fastest-growing media channels in all of the top 20 global markets; however, streaming audio is also expected to decelerate going forward as it also nears saturation in leading markets.

With these potential downtrends on the horizon, PQ Media’s new Global Consumer Spending on Media Forecast 2021-2025 provides you with two site license options, both of which include the following key deliverables that were crafted to deliver actionable market intelligence aimed at helping you successfully overcome the cyclical and secular headwinds produced by the changing media landscape so you can achieve your strategic growth objectives:

- PDF Report & Analysis in PowerPoint slide format delivering 500 slides of actionable strategic intelligence, with 125 slides of analysis and 350 exclusive datagraphs for more efficient and effective strategic comparisons, internal reporting and client presentations;

- Deep-Dive Excel Databook that provides 150 spreadsheet tabs, detailed datasets by country, media sector, segment and category, delivering nearly 100,000 datasets and data points, giving you the most comprehensive perspective of consumer spending on media content and related hardware and software available anywhere.

The following are just some of the key features and benefits you will receive with a site license to the new edition of our annual consumer media spending report:

- Deep-Dive Profiles of the Top 20 Global Media Markets in All 4 Major Regions;

- Spending & Growth Data for 2015-2025, with 5-Year Forecasts to 2025;

- 2 Overall Consumer Media Spending Sectors:

- Consumer Content

- Consumer Technology

- 5 Consumer Media Spending Segments

- Content Unit Purchases

- Content Subscriptions

- Access

- Devices

- Software & Services

- 28 Digital Media & 14 Traditional Media Spending Categories

- 11 Hybrid Media Silos Combining Consumer Spending on Digital & Traditional Media

- Global Consumer Media Content & Technology Market Rankings by:

- Total Spending, Growth & Share by Country

- Annual Per Capita Spending & Growth

- Digital vs. Traditional Media & Tech Spending Shares of Markets

To download a FREE Executive Summary and Sample Datasets from the new Global Consumer Spending on Media Forecast 2021-2025, please fill out the short form that appears after you click the “Free Sample Download” button above. Please ensure your email address is correct because it will be used to send you the links necessary to download the free report samples.