Your cart is currently empty!

Research Reports

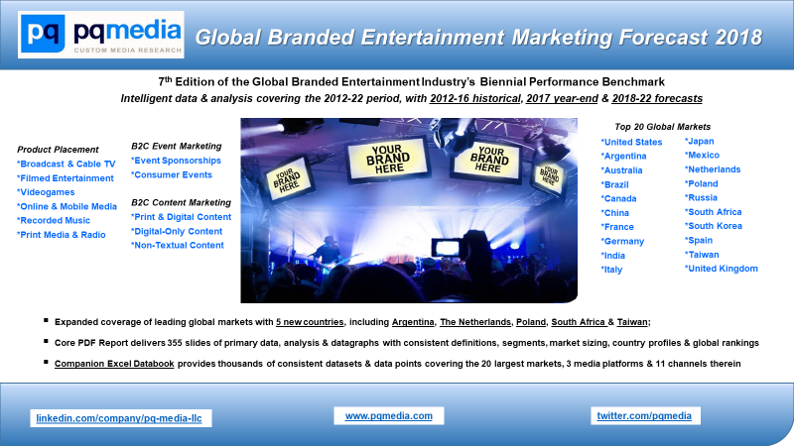

Global Branded Entertainment Marketing Forecast 2018

Description

PQ Media’s Global Branded Entertainment Marketing Forecast 2018 is the 7th edition in this groundbreaking market research series that is recognized worldwide as the industry’s biennial performance benchmark. The new edition has been expanded to include new branded entertainment marketing platforms and channels, as well as five new countries. This year’s Forecast delivers intelligent data and analysis examining the entire 2012-22 period, providing 2012-16 historical data, 2017 year-end estimates, 2018 pacing data, and 2018-22 growth projections.

Since 2005, PQ Media has been the only credible and consistent source of actionable data and insights covering the entire branded entertainment industry. And for 13 years, our Global Branded Entertainment Forecast has been the industry standard for defining, segmenting, sizing, analyzing and projecting outcomes across all four global regions, the 20 largest countries, three key media platforms and 11 marketing channels, including:

- Product Placement in television, film, video games, online media, mobile media, recorded music, radio and print media;

- Consumer Experiential Marketing, including consumer event sponsorships and event marketing; and

- (NEW PLATFORM IN 2018) Consumer Content Marketing, such as hybrid (print digital) content marketing, digital-only content marketing, and non-textual content marketing

PQ Media estimates that global branded entertainment revenues grew at twice the rate of overall advertising & marketing revenues in 2017 to surpass $100 billion for the first time ever, as brand marketers shift their investments to media channels that demonstrate the ability to engage target consumers, create emotional connections and increase sales, despite strong headwinds negatively impacting both digital and traditional media. In particular, brand marketers have become more critical of digital advertising and marketing channels, following a series of issues that surfaced in 2017 related to fake news, ad fraud, placement of ads near controversial content, and the growing use of ad blockers.

In an effort to avoid these pitfalls, brand marketers have increased their use of branded entertainment platforms, such as product placement in media, consumer experiential marketing and consumer content marketing, which have continued to gain acceptance worldwide, leading a number of major advertisers and agencies to form in-house divisions dedicated to planning, negotiating and executing branded entertainment deals with media operators and producers worldwide.

As detailed in the new report, the continued growth of branded entertainment marketing is in sharp contrast to the weaker growth of traditional advertising & marketing platforms, such as television, newspapers, direct marketing and consumer promotions. In addition, PQ Media’s exclusive consumer time spent with media data indicates that younger demographics are moving away from traditional media platforms, while major brands are proactively seeking alternative media channels to engage these more mobile, tech-savvy younger audiences.

The strong desire to gain brand awareness among target consumers, create positive brand associations and, ultimately, produce sales lift will continue to favor branded entertainment marketing worldwide over the next five years. Accordingly, PQ Media expects branded entertainment revenues to continue a strong growth pace throughout the forecast period, particularly in even years when major global sporting and political events will provide additional growth opportunities via product placement in various media, event marketing and content marketing.

PQ Media’s in-depth data and comprehensive analysis are consistently developed, structured and formatted with our proven research methodologies, algorithms and databases, empowering you with easier comparisons of historical, current and forecast data across every global region, leading country, media platform and marketing channel. Key benchmarks featured in this edition include market sizes, growth rates, major PEST trends, various global rankings, and key growth drivers and challenges, all of which are conducive to your internal reporting, client presentations, strategic planning and tactical execution. Other key features and benefits include:

- Expanded coverage of leading markets worldwide, with five new countries added to PQ Media’s Top 20 Global Media Markets in 2018, including Argentina, The Netherlands, Poland, South Africa, and Taiwan;

- Core PDF Report delivers 355 slides of exclusive data, analysis and 500 datagraphs supported by consistent industry definitions, segmentation, market sizing, country-specific profiles, global market rankings, and drill-down profiles of the Top 20 Global Markets, including the United States;

- Companion Excel Databook provides hundreds of consistent drill-down datasets and thousands of actionable data points, market-specific insights and five-year projections covering the Top 20 Global Markets, three major media platforms, 11 marketing channels, and multiple global rankings by region, country, media platform and marketing channel;