Your cart is currently empty!

INTRODUCTION

Dear PQ Media Friends,

Welcome to your FREE issue of the new PQ Media Intellicast newsletter! PQ Media has launched this newsletter to focus on fulfilling a number of outstanding market intelligence needs expressed to us through a survey performed earlier this year of our current, past and new clients who have purchased either our annual market intelligence publications or our custom drill-down research services.

As a member of one of these client verticals, you have been selected to receive each of the first four issues of this newsletter on a monthly basis in October, November, December and through the final FREE issue to be distributed in January 2022.

Our objectives in providing these four monthly issues to you at no cost are to share more of our data and content with you to help educate you on the diverse set of media industry sectors, segments, platforms and channels we cover, which we hope will inform some of your decision-making and give you a better understanding of the breadth and depth of our media and technology industry research coverage.

We encourage you and your colleagues to sign up for this Free Trial via the sign-up form that appears on our website after you click the following link: PQ Media Newsletter Signup. We also encourage you to share your critical feedback – in strict confidence – about the content and usefulness of this new research-driven newsletter by emailing us at info@pqmedia.com.

Following publication of the fourth issue in January 2022, we will be relaunching this newsletter through a cost-effective subscription format, which will be driven by your critical feedback on the value of the data and analysis we’re providing through this free trial period.

Each of the four editions you will receive through January will focus on one of several of the most dynamic and fast-growing segments of the media industry over the past decade, including Branded Enteratinment, Digital Out-of-Home Media, Audio Media, and PQ Media’s holistic perspective on the Global Advertising & Marketing Industry.

I hope your free trial to the new research-driven PQ Media Intellicast will help you grow your business in the coming months, and I look forward to receiving your valuable feedback.

Best regards,

Patrick Quinn

CEO & Publisher

PQ Media LLC

PQ Media Intellicast

PQ MEDIA INTELLICAST (Issue #4, January 2022)

Global Advertising & Marketing Media – Part 1: Definitions & Segmentation

The 4th edition of this newsletter focuses on Global Advertising & Marketing Media, supported by exclusive data gleaned from the recently released 9th annual edition of PQ Media’s Global Advertising & Marketing Spending Forecast 2021-2025. The Forecast is the advertising & marketing industry’s most comprehensive source of actionable market intelligence, econometric data, and expert analysis of traditional, digital & alternative media spending, growth, key trends, emerging opportunities, and projected outcomes in more than 100 media sectors, silos, platforms, channels and categories.

PQ Media’s in-depth coverage of the global media industry provides advertising and marketing spending and growth data for the entire 2015-2025 period, with year-end 2021 estimates and our research team’s expert insights and keen outlook for the 2022-2025 period, including deep-dive profiles and datasets covering all digital and traditional media platforms and channels in the Top 20 Global Markets and the Rest of the Countries in each of the world’s 4 key regions – the Americas, Europe, Asia-Pacific, and Middle East-Africa.

The new edition of the Forecast is one of three reports published annually as part of PQ Media’s Global Media Forecast Series 2021-2025, delivering the only holistic view of the global media economy with each report focusing on one of three industry KPIs: Advertising & Marketing Spending; Consumer Media Usage & Exposure; and Consumer Spending on Media & Technology (see final section below for more details and special bundle offer).

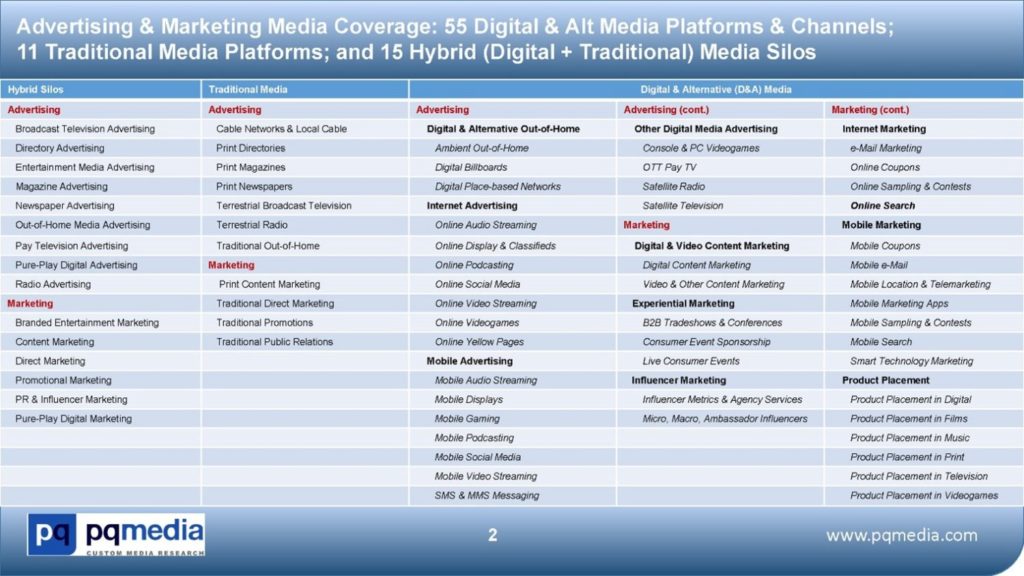

Since the Global Advertising & Marketing Spending Forecast 2021-2025 covers over 100 media sectors, silos, platforms and channels, including 10 overall digital & alternative media platforms; 45 digital & alternative media channels; 11 broad traditional media platforms, and 15 hybrid traditional & digital media silos, we recommend you click on the link above to the report’s landing page and download the Executive Summary, which provides detailed definitions & segmentation of all advertising & marketing media covered in the report.

Global Advertising & Marketing Media – Part 2: Global Market Analysis

Global Ad & Marketing Spend Rebounded 7.2% in 2021 & Projected to Grow at Accelerated 7.6% in 2022, Fueled by Digital Audio, Streaming Video, Mobile Games, Product Placement & Influencer Marketing

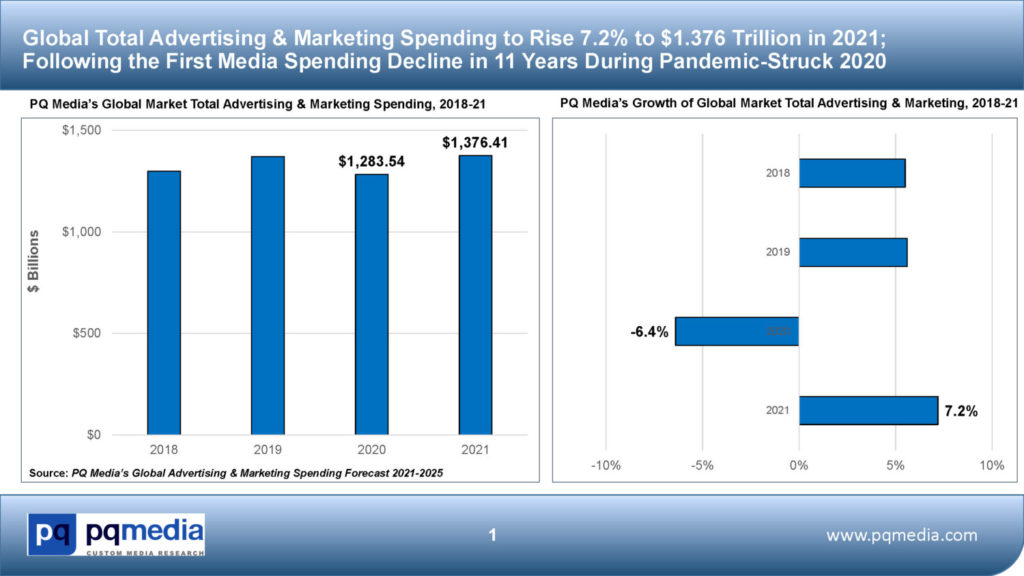

Global advertising and marketing spending, including traditional, digital and alternative media in all major markets worldwide, is on pace to rise 7.2% to $1.376 trillion in 2021 and grow at an accelerated rate in 2022, as the media economy’s rebound is fueled by double- digit growth among 28 of the 45 digital & alternative media channels covered in PQ Media’s just-released Global Advertising & Marketing Spending Forecast 2021-2025.

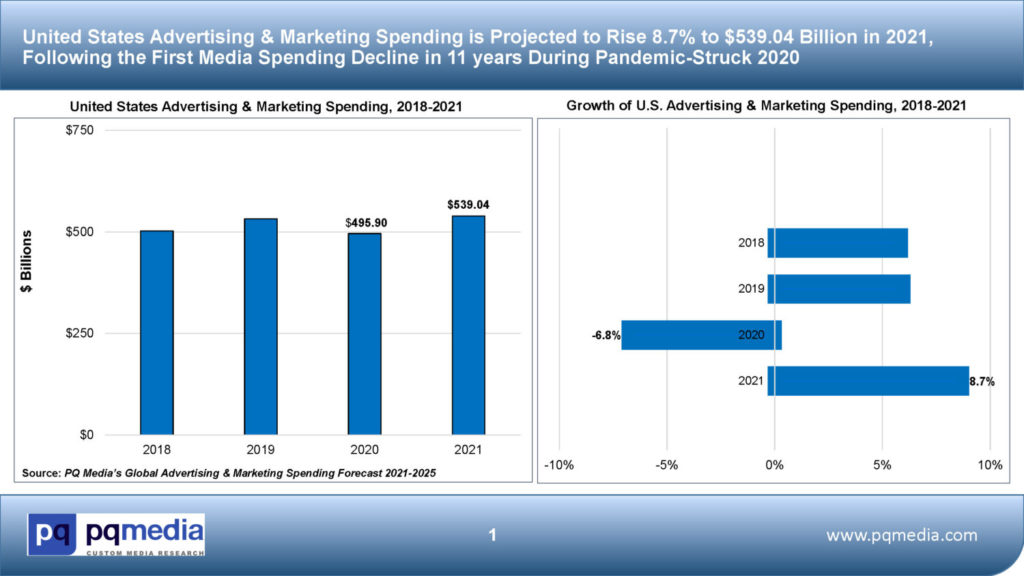

This year’s strong rebound in overall global media spending follows a 6.4% decline in 2020, as the flash flood caused by COVID-19 and the pandemic’s aftershocks resulted in the first worldwide media spending decrease in 11 years. In the United States, total advertising & marketing expenditures fell 6.8% last year, as the pandemic lockdowns had the dual effect of squelching a decade-long expansion of the overall media economy, while also hastening the emergence of new advertising & marketing opportunities in streaming video, digital audio, mobile gaming, social media, influencer marketing, digital product placement and virtual events, according to PQ Media.

The global advertising sector is projected to grow 6.2% to $628.28 billion in 2021, while the overall marketing sector is expected to grow 8.1% to $748.13 billion. Global digital & alternative media spending is projected to increase 12.6% in 2021 to $613.89 billion, while global traditional media growth is expected to rise 3.3% to $762.52 billion.

In the US, which will remain the world’s largest media market and rank third as far as spending growth, total ad & marketing spend is pacing for an 8.7% increase this year to $539.04 billion, driven by double-digit upside in both the overall digital & alternative advertising and marketing platforms. Combined US digital & alternative media expenditures are on pace to grow 14.7% to $257.91 billion in 2021, while US traditional advertising & marketing is estimated to finish the year up 3.7% to $281.13 billion, according to the Global Advertising & Marketing Spending Forecast 2021-2025

The robust recovery in overall global and US media spending this year returns these markets to their pre- pandemic 2019 levels, fueled by double-digit growth in streaming audio and video advertising, digital videogame advertising, digital product placement, social media advertising and influencer marketing, among others. In addition, several top 20 global media markets, such as India, Argentina, the US and China, are all expected to post 9-10% growth rates in 2021.

On the digital front, the unprecedented shakeup of the media economy in 2020 positioned newer digital media channels to capitalize on the pandemic-fueled turbulence across the industry, as leading advertisers were compelled to quickly change media strategies and tactics to target, engage and activate overwhelmed consumers. Astute brand marketers shifted their budgets to media channels capable of breakthrough engagement, which led to the proliferation of new streaming video and audio services concurrent to the pandemic lockdowns forcing consumers indoors for longer periods, driving up digital video, audio and game consumption in 2021 as well. These trends were also a boon to product placement and influencer marketing, as well as social media advertising.

Among the fastest-growing digital & alternative media channels worldwide in 2021 were mobile smart tech marketing, which surged 118.1%, followed by digital podcast advertising (up 38.5%), mobile game advertising (up 25.3%), influencer marketing (+22.8%), mobile search advertising (+21.3%), streaming video (+21.0%), streaming audio, product placement and social media. The largest digital & alternative media channels in 2021 were mobile search at $56.35 billion, online search at $45.14 billion, online display & classifieds ($44.52 billion), consumer event sponsorship ($35.68 billion), mobile social media, and mobile video streaming.

But the good fortune wasn’t shared by all media platforms, channels and top 20 markets in 2021. Among the unfortunates were print newspapers, magazines and directories, as well as online search and display ads, all of which posted declines in 2021. Nevertheless, print newspapers remains the fifth-largest traditional media channel worldwide this year, while the top four include traditional direct marketing with spending of $205.72 billion, broadcast television advertising at $171.86 billion, traditional promotions ($143.81 billion), and cable TV ads ($72.08 billion). The fastest-growing traditional media channels in 2021 were public relations (up 10.5%), print content marketing (up 7.4%), and broadcast radio (+7.3%).

However, we began to see a gradual leveling of some of the pandemic-fueled cyclical trends in late 2021 and the re-emergence of secular trends that have been driving the industry for years in early 2022, particularly among consumer time spent with media, but also in advertising & marketing spending. And PQ Media believes that two key variables could negatively impact its current spending projections for 2022, including the emergence of the Omicron variant in late 2021 and rising global inflation, both of which could stifle growth.

In addition, pandemic-heated media channels growing at double-digit rates will begin to face decelerating growth in the years ahead, particularly streaming video services that are experiencing churn for the first time. PQ Media researchers also believe it’s unlikely movie theater admissions and cinema ad spend will ever reach their pre-pandemic peak of 2019, as the window for films being released to streaming video services continues to shrink. Click on the short YouTube video below of PQ Media CEO Patrick Quinn discussing the pandemic’s digital media boost and cinema’s likely business peak in 2019:

Global ad & marketing spend is projected to grow 7.6% in 2022, as both the overall advertising and marketing sectors are estimated to post accelerating growth, driven primarily by 12.5% upside in the digital & alternative media segment.

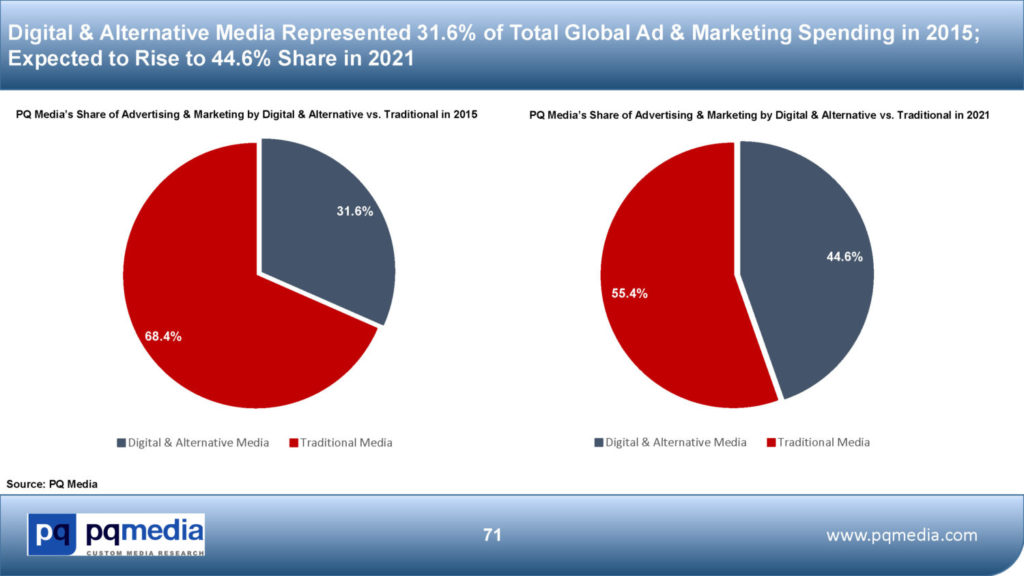

With digital & alternative media projected to post much stronger growth than traditional media over the next several years, PQ Media forecasts that digital & alternative media will command a larger share of the total ad & marketing pie for the first time in 2023 – both in the overall global market and in the US.

More About the Forecast, Free Sample Downloads & Special Bundle Offer

PQ Media’s 9th annual Global Advertising & Marketing Spending Forecast 2021-2025 covers over 100 media sectors, silos, platforms and channels, including the advertising and marketing sectors; 15 hybrid traditional & digital media silos; 10 overall digital & alternative media platforms; 45 digital & alternative media channels; and 11 overall traditional media platforms.

Site licenses include two deliverables: 1) PDF Report & Analysis delivering a 460-slide deck with hundreds of datagraphs, expert insights and detailed profiles of the top 20 global media markets; and 2) Deep-Dive Excel Databook providing over 100,000 datasets and datapoints covering the 2015-2025 period by country, media sector, silo, platform and channel. To download a Free Executive Summary and Sample Datasets, click Global Advertising & Marketing Spending Forecast 2021-2025.

The new edition of the Forecast is one of three reports published annually as part of PQ Media’s Global Media Forecast Series 2021-2025, delivering the only holistic view of the global media economy with each report focusing on one of three industry KPIs: Advertising & Marketing Spending; Consumer Media Usage & Exposure; and Consumer Spending on Media & Technology. Each report is available as either a standalone product or as part of our Special Three-Report Bundle License, which Saves You $2,000 (or 20%) Off the standard rates for individual reports. Click on the Series link above for more details on this special offer.

More About PQ Media

PQ Media delivers intelligent data and analysis to leading media and technology organizations worldwide through annual market intelligence reports and custom drill-down research services. PQ Media uses a proprietary econometric methodology to define, segment, size, analyze and project growth across over 300 traditional, digital and alternative media, which drives our various research publications, report series, and is used to provide our clients with on-demand custom drill-down research deliverables.