Your cart is currently empty!

Research Reports

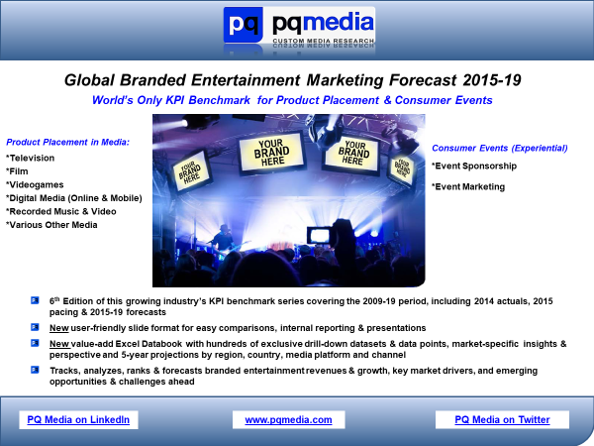

Global Branded Entertainment Marketing Forecast 2015

Description

- 6th edition of this growing industry’s KPI benchmark series covering the 2009-19 period, including 2014 actuals, 2015 pacing, and 2015-19 forecasts

- New user-friendly slide format for easy comparisons, internal reporting and presentations

- New value-add Excel Databook with hundreds of exclusive drill-down datasets, market-specific insights, and 5-year projections by region, country, media platform and channel

- Tracks, analyzes, ranks and forecasts branded entertainment revenues, growth, key market drivers, and emerging opportunities and challenges ahead

Global Branded Entertainment Revenue Hit $73.27 Billion in 2014, Double What Was Generated by Mobile Advertising & Marketing, as Brands Seek to Engage Target Consumers More Effectively Amid Ad-Skip Tech, On-Demand Media Consumption

Amid the rapidly changing global media and communications landscape, branded entertainment marketing, including consumer events and product placement, is posting accelerating growth during the upcoming five year forecast period as it has emerged as a leading alternative marketing strategy to digital advertising & marketing according to a new global forecast from PQ Media, the leading provider of global media econometrics.

Five years removed from the Great Global Recession, branded entertainment marketing had continued to gain acceptance among brand marketers worldwide, with many forming dedicated divisions to accelerate the negotiation process with global media companies. According to PQ Media’s exclusive spending and growth datasets, branded entertainment revenues rose 6.3% in 2014 to reach $73.27 in 2014, trailing only combined internet advertising & marketing revenues among the nine digital & alternative media platforms it tracks, including being double the size of revenues currently being generated by mobile advertising & marketing. The US is the world’s largest branded entertainment market, accounting for 47.1% of total branded entertainment revenues.

The resilience of global branded entertainment marketing spend as detailed in the current report is in sharp contrast to the weaker growth of traditional brand marketing platforms, such as broadcast television, newspapers, direct marketing and consumer promotions. PQ Media’s data on media consumption shows that younger demographics are shifting away from traditional advertising and marketing platforms, and brands are becoming more proactive finding different media platforms that will engage with this more tech-savvy audience.

The need to gain brand awareness among consumers, create positive brand associations which can impact consumer sales will underpin branded entertainment marketing global development for the foreseeable future. This will be especially true for multinational brand marketers.

PQ Media expects global branded entertainment revenues to post accelerated growth annually during the forecast period, spurred by product placements in nascent markets like music and other media, particularly print media that are seeking alternative revenue streams to counter the falling advertising market. Meanwhile, consumer events are increasingly becoming an important part of integrated media campaigns, especially with new product launches, some of which were tabled over the past five years due to sluggish economies worldwide.

PQ Media’s 6th edition Global Branded Entertainment Marketing is the industry’s worldwide benchmark for spending, growth and trends data, covering the four major regions, 15 leading markets, and each media platform – TV, film, videogames, internet, mobile and music, and others, as well as consumer-facing event sponsorships and event marketing – in an extremely rich 250-slide PowerPoint deck in PDF featuring a first-ever value-add Excel Databook, which delivers the deepest dive ever conducted in the Top 15 Global Markets, including the US, Brazil, UK, Germany, China and Australia, among others. This unprecedented package of competitive intelligence better equips you to:

- Quickly compare and contrast individual markets against global performance;

- Quickly compare and contrast branded entertainment against GDP and the overall advertising & marketing ecosystem within each mark;

- Identify countries with the greatest investment opportunity based on projected forecast growth rates;

- Develop sound strategic initiatives via intelligent data for smarter, faster business decisions

Also provided are a consistent and complete set of consumer event and product placement definitions; exclusive findings and predictive analysis with more than 325 datagraphs. To download a FREE Executive Summary, Dataset Samples and Table of Contents, or to purchase your copy of this highly anticipated new edition, all you need to do is sher a few bits of information with us below in strict confidence.